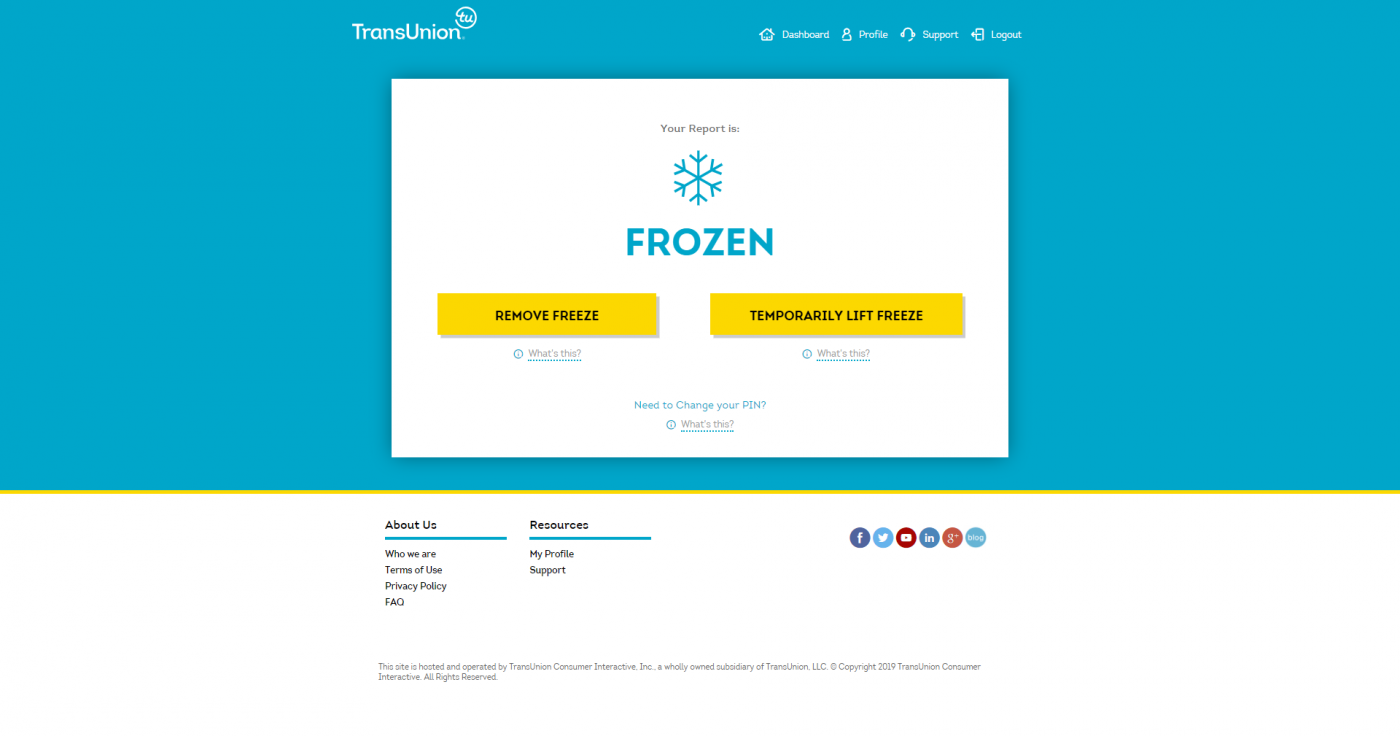

How Credit Freezes WorkĪ credit freeze bars any access to your credit report by lenders and other parties seeking to view your credit history. To be as safe as possible, it is imperative that you protect all your personal data from theft as thoroughly as you can. To avoid such breaches, make sure that your personal data is always secure so that when you eventually can obtain a credit card freeze, it will be useful. Even worse, the scammer can sell the stolen information to other bad guys online. A scammer who is already privy to your account number and other personal data can still use your card to make purchases. It can’t help you fix the breach that has already occurred. If you freeze your credit file after your personal data has already been compromised, the freeze can only help you to prevent future breaches of the file. It also prevents unauthorized access to your personal data. Freezing your credit file therefore provides you with protection against the kind of fraud often perpetrated by identity thieves. This makes it impossible for lenders and identity fraudsters to open the account or inquire about your credit history until you remove the freeze. When you freeze your credit, your credit-report file is locked.

#Equifax freeze my how to#

Until then, learning how credit freezes work and understanding how to protect yourself from identity fraud are of utmost importance. However, because of recent large data breaches in the Canadian financial community, a new bill introduced by Quebec may see light of the day and make it possible for Canadians to freeze their credit files. What these services don’t provide is a good way to prevent fraud to begin with. With credit monitoring, you receive alerts via email when significant variations are noted on your credit reports, including information about new accounts that have been opened. The fees charged and services provided depend on which plan you choose. They will provide you with credit monitoring for a fee ranging from $11.95 a month to $29.95 a month. If you can’t do that, what can you do to protect yourself from identity theft? At the moment, you can use anti-fraud services offered by credit reporting bureaus like Equifax and TransUnion to protect yourself. Credit-card customers in Canada cannot yet freeze their credit files.

But so far, no action has been taken to require credit card firms to provide this capability. In August 2019, Quebec proposed a bill that would allow clients to freeze access to their credit reports. In 2019, for instance, a CBC marketplace investigation revealed that although cases of identity theft and fraud are numerous in Canada, most provinces and territories have no intention of introducing legislation to tackle the problem. Every year, an estimated 27,000 Canadians report identity fraud to the authorities.

0 kommentar(er)

0 kommentar(er)